Écrit par Andrew Bozzato et Oscar Crawford-Ritchie

Les pays membres de l’OTAN ayant récemment convenu de porter leurs dépenses de défense à des niveaux inédits depuis la Seconde Guerre mondiale, le moment semble bien choisi pour se pencher sur un thème qui fait beaucoup parler depuis quelque temps, à savoir le rôle croissant que jouent le capital-investissement et le capital-risque dans le secteur de la défense.

Comme nous le notions dans notre billet récent Occasions de capital-investissement et échanges commerciaux à l’honneur à l’événement CVCA Invest Canada, la nécessité de plus en plus pressante d’investir dans la défense crée de nouvelles occasions de capital-investissement dans les pays occidentaux, une tendance à laquelle le Canada n’échappe pas.

Voici quelques facteurs expliquant cette tendance :

- Des événements géopolitiques récents incitent les pays occidentaux à recentrer leur attention pour renforcer sans tarder leurs capacités nationales de fabrication et d’acquisition de matériel de défense.

- L’investissement dans le secteur de la défense ne se cantonne plus à la fabrication lourde classique. Il s’étend désormais à des entreprises actives dans les domaines de l’IA, de l’espace, des communications, des infrastructures, des technologies à double usage, des logiciels, de la cybersécurité et d’autres encore que les investisseurs, auparavant, n’associaient pas à la défense.

- L’évolution du rôle des politiques environnementales, sociales et de gouvernance (ESG) et du filtrage des placements offre des occasions de reconsidérer les fondamentaux de l’investissement dans un secteur qui, précédemment, aurait pu être exclu d’emblée.

Regain d’intérêt pour la défense

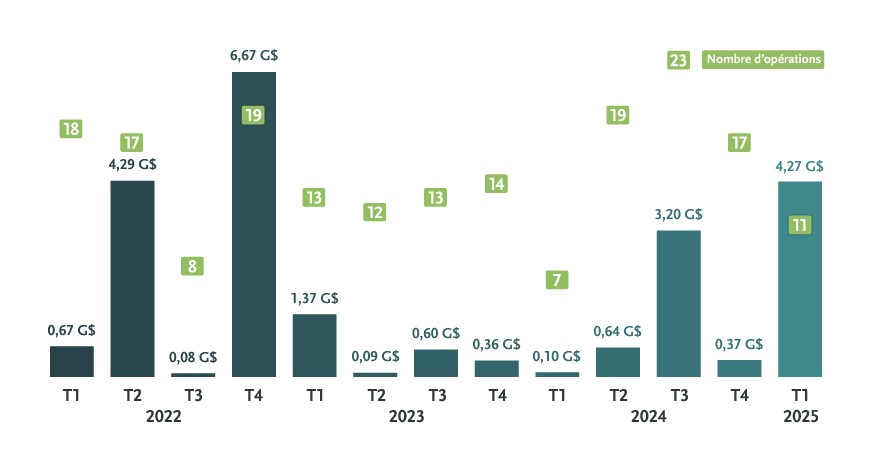

L’investissement en capital et en capital-risque dans le secteur de la défense poursuit sur sa lancée dans un monde aux prises avec des tensions géopolitiques croissantes et changeantes, des capacités de défense en décalage avec les besoins, et des budgets de défense nationaux limités. Bain & Company et le Financial Times rapportaient récemment que la valeur des opérations de capital-risque dans le secteur de la défense avait été multipliée par 18 au cours des dix dernières années, et qu’une forte accélération avait été observée depuis 2019. Selon S&P Global Market Intelligence, entre le 1er janvier et le 16 mars de cette année, la valeur annoncée des investissements soutenus par du capital-investissement et du capital-risque dans l’aérospatiale et la défense à l’échelle mondiale s’est élevée à 4,27 milliards de dollars américains, soit presque autant que les 4,31 milliards qu’ont représenté les opérations avec apports de capitaux privés dans ces mêmes secteurs pour l’ensemble de 2024.

Investissements soutenus par du capital-investissement et du capital-risque dans l’aérospatiale et la défense, 2022-2025

S&P Global Market Intelligence. Chiffres du T1 2025 à jour au 16 mars 2025.

Dans son récent rapport The New Martial Plan, la société de gestion d’actifs The Carlyle Group observe que l’augmentation des dépenses de défense ouvre de grandes perspectives pour les capitaux privés. Selon elle, les sociétés de capital-investissement sont bien placées pour accompagner étroitement les gouvernements dans leurs efforts pour se doter d’un nouveau secteur de la défense.

Pour notre part, nous pensons que l’investissement de capital-risque dans ce secteur continuera d’augmenter, tandis que l’intérêt pour le capital-investissement sera appelé à s’intensifier alors que les gouvernements du monde entier chercheront des partenaires du secteur privé pour accroître fortement et rapidement leurs capacités d’acquisition et de production de matériel de défense au cours de la prochaine décennie.

Les technologies de défense gagnent en visibilité

La poussée des injections de capitaux privés constatée dans le secteur s’explique beaucoup par l’évolution de ce qui est considéré comme un investissement en « défense ». Cette catégorie englobe désormais des entreprises de multiples domaines (logiciels, cybersécurité, technologies à double usage, espace, communications, IA, technologies autonomes, apprentissage automatique et autres) que nous désignerons globalement dans ce billet comme les « technologies de défense » (en anglais, DefTech). Les investisseurs privés recherchent activement de nouvelles opérations dans tous ces créneaux; ils cherchent également à mobiliser des fonds et à constituer des équipes spécialisées dans l’investissement en défense. Le Financial Times rapportait récemment (d’après des données de Pitchbook) que les injections de capital-risque dans les technologies de défense avaient nettement augmenté ces dernières années, et que celles de 2025 étaient déjà en voie de dépasser, en nombre, celles de 2024.

Par le passé, bien des acteurs privés ne pouvaient pas se permettre d’investir massivement dans le secteur traditionnel de la défense en raison du temps qu’il fallait pour passer de l’approvisionnement à la fabrication. Mais les choses changent. Les délais plus courts maintenant observés dans les marchés publics et dans de nombreux segments de la fabrication de matériel de défense moderne rendent les opérations plus attrayantes. Des investisseurs privés de tous types montrent un intérêt grandissant pour le secteur à mesure que les technologies de défense gagnent en visibilité et qu’on constate la forte croissance qui se dessine pour de multiples segments de ce marché.

De nouvelles occasions pour les investisseurs privés

Les investisseurs en capital-risque et en capital-investissement sont bien placés pour jouer un rôle important dans la croissance du secteur névralgique de la défense, appelé à connaître une forte expansion. Nous nous attendons à ce que les gouvernements du monde entier continuent à y encourager ces deux formes d’investissement par le biais d’initiatives favorisant les partenariats public-privé. Parmi les autres catalyseurs, on peut citer des investissements massifs récents dans la recherche-développement axée sur la défense, comme le Fonds OTAN pour l’innovation, doté d’un milliard d’euros. Ce fonds de capital-risque est destiné à financer, dans les pays de l’OTAN, des sociétés de technologies de rupture (deep tech) proposant des solutions dans des domaines aussi variés que l’IA, l’énergie, l’autonomie, les technologies quantiques, les communications et l’espace.

Nous prévoyons que le besoin d’apports en capital-investissement et en capital-risque augmentera considérablement au cours des prochaines années, avec l’accroissement de la demande de matériel de défense, et que la part de la fabrication lourde classique diminuera nettement au profit des technologies émergentes, dont l’IA, les technologies de défense et les composantes logicielles du secteur de la défense.

Pour discuter de l’actualité récente et des occasions émergentes dans le secteur de la défense, n’hésitez pas à contacter l’un des auteurs.

Veuillez noter que cette publication présente un aperçu des tendances juridiques notables et des mises à jour connexes. Elle est fournie à titre informatif seulement et ne saurait remplacer un conseil juridique personnalisé. Si vous avez besoin de conseils adaptés à votre propre situation, veuillez communiquer avec l’un des auteurs pour savoir comment nous pouvons vous aider à gérer vos besoins juridiques.

Pour obtenir l’autorisation de republier la présente publication ou toute autre publication, veuillez communiquer avec Amrita Kochhar à kochhara@bennettjones.com.