A New Era for Defence Investment

Many of the trends that we discussed in our recent blog post, Private Equity and Venture Capital Investors Showing Renewed Interest in the Defence Industry, have continued to accelerate during the remainder of 2025. Private investors are viewing defence industry investments, with a particular focus on defence technology (DefTech), as a credible and scalable asset class that is expected to drive returns going forward. From a government policy perspective, defence investment is increasingly recognized for its critical importance in growing an economy's industrial base, supporting societal stability and addressing national security risks. This shift marks one of the most fundamental realignments in public sector policy priorities in the past quarter century and is driving reallocation within private capital markets.

Policy Momentum, 2025 Budget and Fostering Development of Dual-Use Technology

Government action is amplifying and accelerating the private-capital interest and momentum in this sector. The Canadian government's recently announced two-stage plan commits Canada to spend at least 2% of GDP on defence this fiscal year, meeting NATO’s target five years earlier than previously planned, and aims to raise spending to 5% of GDP by 2035, including 1.5% for broader security investments such as critical infrastructure and dual-use technologies. The total commitment exceeds C$1.2 trillion over the next decade.

This commitment was formalized in the 2025 Federal Budget, which announced a C$80 billion investment (including a previously announced C$9 billion) in defence and security over the next five years—the largest in decades. The plan allocates that funding to recruitment and retention, infrastructure and equipment (including digital and cyber infrastructure), industrial support focused on modernizing fleets, expanding Arctic and maritime surveillance and strengthening cyber and space capabilities. The Budget also confirmed the creation of the recently announced Defence Investment Agency (DIA), which will overhaul and streamline Canadian defence procurement with a focus on procuring Canadian technology and equipment, and the development of a Defence Industrial Strategy aimed at funding and catalyzing research and innovation in numerous areas, including quantum computing, and rebuilding domestic production capacity, strengthening supply chains and advancing Canadian innovation in aerospace, shipbuilding and advanced manufacturing.

The Canadian government's policy priorities also recognize that modern security considerations now require investment in capabilities that extend far beyond traditional military platforms, leading to defence expansion into adjacent categories already popular in mainstream venture capital, such as AI, cyber, space, logistics and semiconductors. The Budget includes C$180 million to establish sovereign space launch capability and C$450 million to support the development of innovative critical minerals processing technologies investments in Canadian critical minerals projects and P of a critical minerals stockpiling mechanism to strengthen Canadian and allied national security.

Especially notable is C$335 million to support quantum computing technologies and C$650 million to develop and commercialize dual use technologies in aerospace, automotive, marine, cybersecurity, AI, biodefence and life sciences. The broader focus on dual-use technology and other investments not traditionally viewed as strictly defence-related is crucial because it provides a necessary business case for certain investors with ESG, pension and similar constraints who are still restricted in some ways and may continue to otherwise avoid investments in the defence sector.

Finally, one of the most important budget announcements for readers of this update is the C$1 billion allocated to the Business Development Bank of Canada to provide loans, venture capital and advisory services to help small- and medium-sized businesses contribute to Canada's defence and security capabilities.

Beyond Canada, NATO’s €1 billion Innovation Fund, backed by 24 member nations, continues to direct investment into deep-tech and defence startups, integrating commercial innovation into allied programs. We are also looking forward to the creation of a new international defence-specific lender similar to the World Bank, the Defence, Security and Resilience Bank (DSRB), that is backed by NATO members and other allied nations and would support the deployment of capital by private lenders, including Royal Bank of Canada in Canada, JPMorgan Chase & Co. in the United States, ING Group NV in the Netherlands and Commerzbank AG and Landesbank Baden-Württemberg in Germany.

Private Capital Allocation Continues to Accelerate

Recent government initiatives across the globe are accelerating market trends in the global defence and DefTech sector as it transforms from a fragmented and niche investment category into a rapidly growing mainstream asset class.

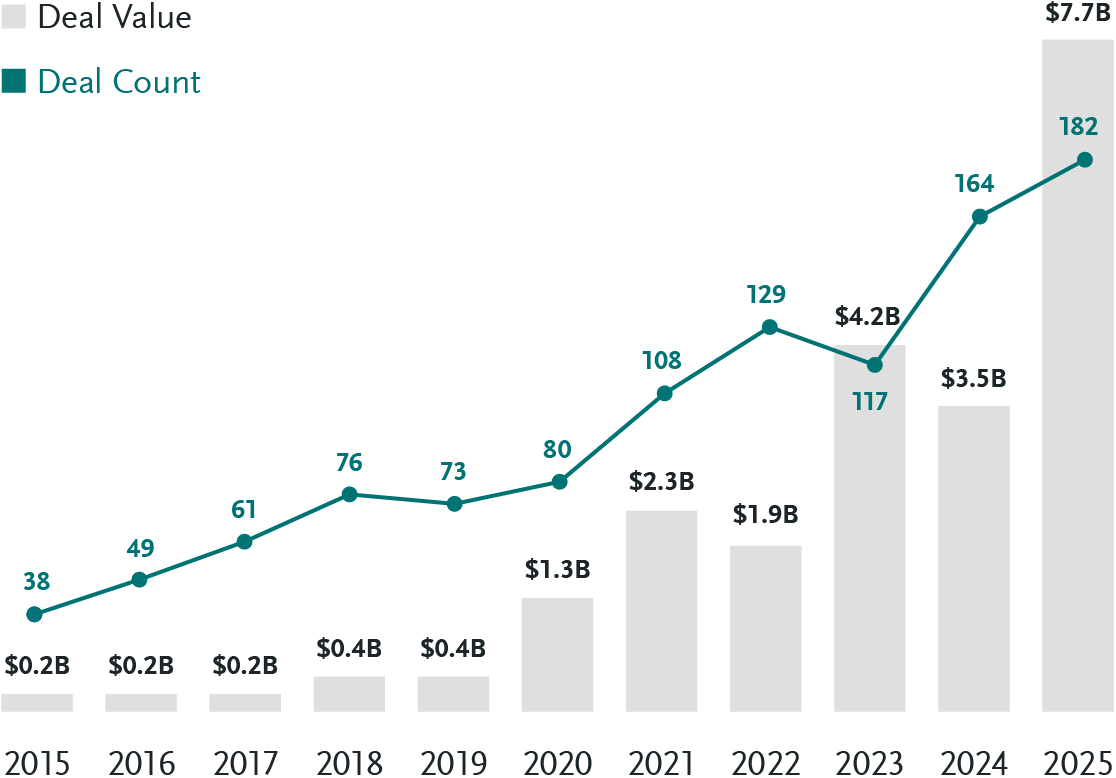

According to PitchBook data, global VC defence tech deal value is likely to reach US$10 billion by year end, having hit US$7.7 billion already—more than double the amount raised in 2024. In Europe alone, defence tech startups raised US$4.2 billion in the first nine months of this year, almost reaching 2024’s total.

VC Funding for Defence Tech Startups (US$)

PitchBook data as of October 15, 2025

Private-sector momentum is also being driven by initiatives such as JPMorgan Chase’s US$1.5 trillion Security and Resiliency Initiative, launched in October 2025. The initiative allocates up to US$10 billion for direct equity and venture investments in critical sectors including defence and aerospace.

This record fundraising reflects the intersection of geopolitical urgency and scalable technological advancement. Investors are increasingly targeting dual-use technologies, which have both civilian and military applications, as a way to balance ESG mandates with exposure to defence-aligned growth.

Is the Optimism Justified?

Despite clear policy backing and strong capital inflows into defence and dual-use technology, the sector faces some skepticism about execution risk and the pace at which this capital can be deployed and successfully exited. These concerns feed a persistent “hype narrative” suggesting that valuations may be outpacing operational progress.

A major friction point in the defence sector is the clash between traditional financial timelines and the slow, complex mechanisms of government acquisition. Governments remain the primary customers for defence firms, leaving investors few alternatives and forcing companies to operate on government schedules–with government procurement systems often experiencing significant lags leading to long delays and uncertainty for investors. These inefficiencies compound another challenge for VC and private equity firms: exit constraints. With few acquirers beyond the largest defence industry participants and government buyers, liquidity options may be limited for certain technologies and equipment. However, with modernized government policies and initiatives, such as the DIA in Canada, and the emergence of dual-use technologies and DefTech as key areas of investment, investors are increasingly looking past prior concerns and viewing current valuations as justified and poised for continued growth.

Outlook: From Fragmented to Investable

A tension between demand and structural friction defines the current investment environment. On one hand, long-term policy commitments, such as Canada’s plan to allocate over C$1.2 trillion and reach 5% of GDP in defence and security spending by 2035, signals long-term optimism. On the other hand, long procurement cycles, national security restrictions and limited exit opportunities continue to slow progress and could potentially frustrate investors. Our view is that the DIA and Canada's new Defence Industrial Strategy will be critical in addressing the latter to allow the new demand to fully benefit the Canadian economy and both Canadian and allied companies participating in this growth. Many investors already believe that the strongest opportunities now lie in dual-use and enabling technologies that attract mainstream VC while addressing military needs in fields such as AI, autonomy, and advanced manufacturing.

As we look ahead, the convergence of private capital, government policy and technological innovation is continuing to build an agile and investable defence ecosystem. We are increasingly called upon to advise our diverse client base on acquisitions, investments and commercial transactions in this increasingly important area and we remain on the forefront of this sector as defence and dual-use technologies continue to rise in economic importance and as government policy changes continue to transform this area.