Private equity investment in the food and beverage industry continues to steadily increase, driven in part by evolving consumer preferences and a heightened focus on sustainability. In 2024, private equity deal activity in North America in the beverage sector alone saw a 45 percent increase compared to the previous year, with notable investments in plant-based and health-oriented brands. Deal activity in 2025 is currently on track to surpass previous highs, indicating continued confidence and investment in food and beverage-related businesses. We expect these recent trends to continue and for a new catalyst–consumer desire to increasingly seek out and buy locally made products–to continue to drive private equity interest in this space.

Strategic Shifts and Investment Patterns

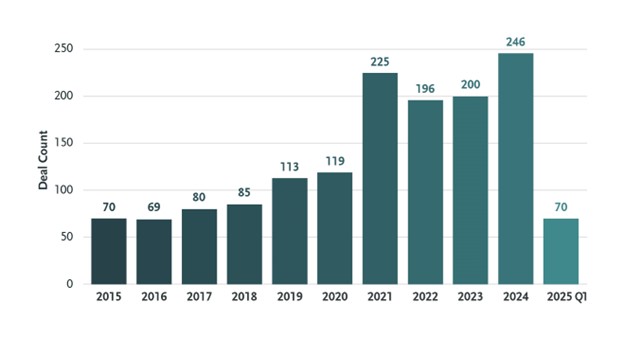

While overall consumer discretionary spending remains cautious in 2025, certain industries are experiencing growth. Private equity investment in the food and beverage industry has experienced a significant resurgence since 2021, with 2024 marking a notable peak in deal activity.

Private Equity Deal Activity

North American Food and Beverage Industry

Source: PitchBook data

In North America, the number of private equity deals in the food and beverage industry increased by 29.6 percent in Q1 2025, compared to the same quarter the previous year. This uptick partially reflects a strategic response to evolving consumer preferences and market dynamics, with private equity buyers focusing more on health-conscious, sustainable and innovative business models to drive growth and shape the future landscape of the industry.

New Opportunities for Private Equity to "Buy Local"

Recent geopolitical events have been driving a surge in consumer nationalism, with a significant focus in Canada and other countries towards directing purchases to locally-owned companies and supporting domestically produced goods. In our experience, this trend is particularly evident in the food and beverage industry. Recent surveys conducted by the Angus Reid Institute indicate that 85 percent of Canadians are actively replacing American products with Canadian alternatives. This buy local global movement presents private equity firms with strategic opportunities to invest in Canadian businesses poised to capitalize on this trend and potentially realize new growth opportunities. Companies that emphasize domestic production appear increasingly well-positioned for growth, offering avenues for value creation through brand strength and operational scaling. We expect this trend to continue to be an important catalyst for new private equity investment and M&A in this sector going forward.

Bennett Jones M&A, Private Equity And Agribusiness Practices

The Bennett Jones M&A and Private Equity groups are leaders in Canada. Our clients include portfolio companies and sophisticated financial sponsors of all types who are looking to balance risk with expected return and who require tailored advice from the fund formation, initiation of the investment and through to exit. Bennett Jones represents all sides in private equity transactions, with particular depth on behalf of US and domestic financial sponsors. At Bennett Jones, our connection with the food and agribusiness sector weaves through the entire Canadian value chain. From major conglomerates scaling operations to meet the surging global food demand, to cutting-edge innovators rewriting the future of the industry, and dynamic companies navigating the increased pace of litigation in Canada's food sector, we support businesses at every step of their journey.

Our team—renowned for its deep-rooted industry expertise—stands ready to guide Canadian, US and international clients through the intricacies of their operations.

To discuss the developments and opportunities in the food and beverage industry, please contact one of the authors.