Earnouts in M&A Deals

Earnouts continue to be a popular tool in M&A deals to manage risk and uncertainty, and close valuation gaps between buyers and sellers. SRS Acquiom reports that earnouts were used in 22% of non-life sciences private-target M&A transactions in 2024, up from 15% in 2019, and are even more common in the lower middle-market (LMM). For non-life sciences deals in 2024 with closing payments of US$50 million or less, 27% included an earnout, up from 20% of LMM deals in 2019.

As during the pandemic period, ongoing uncertainty with respect to the economic impact of tariffs has reduced the utility of historical financial results in supporting valuations and as a reliable indicator of future financial performance, resulting in the use of earnouts to help allocate this risk.

With the increasing reliance on earnouts, we have seen continued focus on, and negotiation of, the metrics on which earnouts are based and creativity around how they are structured. We have observed sellers and buyers remaining alert to potential vulnerabilities of certain financial metrics such as changes in cost and expense structures and in accounting treatments, with the majority of deals landing on EBITDA-based milestones. In some circumstances, we have also seen non-financial benchmarks, such as receipt of regulatory approvals, being used.

This increased use of earnouts has also started to result in a proliferation of litigation, as actual payouts are often proving to be significantly less than the maximum possible as negotiated in the original agreements. Given the bespoke and increasingly complex nature of many earnout provisions, this litigation is highly fact specific and can be very costly and time consuming to resolve.

Cross-Border Dealmaking

Getting deals done in the face of extreme international economic and political volatility, coupled with increasing fund liquidity pressures and regulatory scrutiny, were key themes at M&A-focused panels at the recent Fall Meeting of the American Bar Association's Business Law Section, which was held in Toronto from September 18 to 20, 2025.

Panelists discussed how recent amendments to the national security guidelines of the Investment Canada Act (ICA) make clear that economic security is a distinct factor for the government to consider in determining whether a transaction may be injurious to Canada's national security. This has led to greater focus on matters such as supply chains, critical minerals and data sovereignty amid a broader international trend of deglobalization. In response, some dealmakers are now choosing to be more proactive with respect to pre-closing ICA notifications to avoid the possibility of an unexpected and undesirable post-closing review that subjects parties to unpredictable scrutiny. International buyers are seeing creative partnerships, such as with Canadian pension funds or First Nations groups, as potentially creating a smoother path to closing.

The upcoming maturity walls of many private equity funds has also been a driver of deal activity, according to panelists, with some funds electing to offload second-tier assets at discounted valuations to create near-term liquidity for their investors. Preparatory sell-side activity appears to be increasing, even if such activity has not yet evolved into full-blown processes, and the rise of alternative liquidity structures, such as continuation funds, secondaries transactions and dividend recaps, and the still significant levels of dry powder are expected to lead to more vigorous activity levels as we move into 2026. The Canadian market, with its relatively stable macroeconomic backdrop and global investor appetite seems well-positioned to capitalize on some of this momentum.

Canadian M&A Activity by Industry

Technology continues to lead the way in deal count in Canada, according to Mergermarket data, being the clear front-runner in each of the past five quarters. Industrials remains in second place position. Energy & Natural Resources activity has also been strong, and we expect this trend to continue in Q4, particularly if record high gold prices continue.

Canadian M&A By Industry: Q3 2025

| Industry |

Deals |

| Technology |

101 |

| Industrials |

90 |

| Energy & Natural Resources |

69 |

| Business Services |

44 |

| Financial Institutions |

43 |

| Consumer & Retail |

25 |

| Healthcare |

24 |

| Real Estate |

14 |

| Transportation |

12 |

| Communications, Media & Entertainment |

7 |

Mergermarket as of September 30, 2025

Looking Ahead

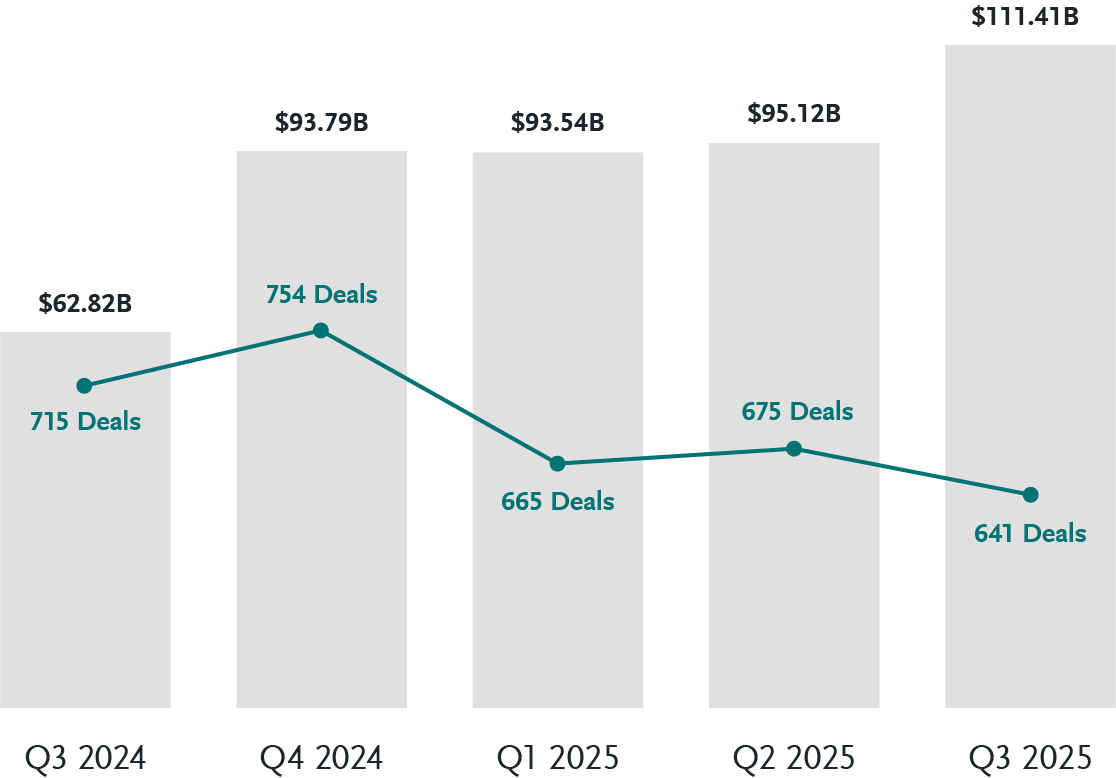

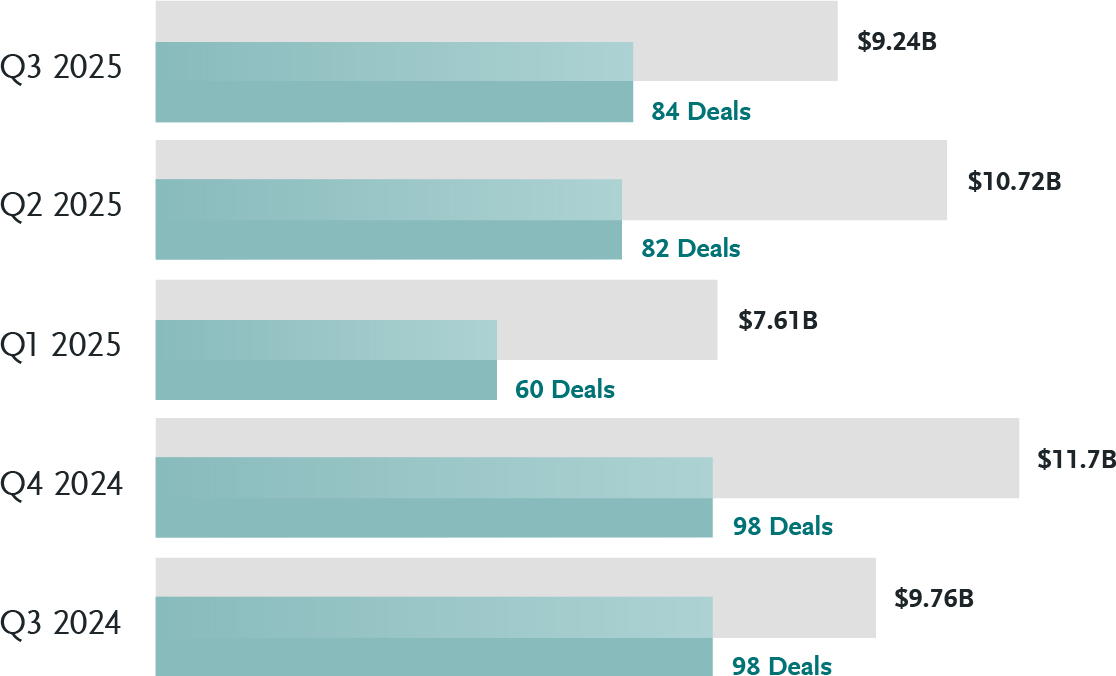

There were positive developments in M&A activity in the third quarter of 2025. Total deal value was up in Canada and globally, interest rates went down and dealmaking over the summer was hotter than expected. As we move into the final quarter of the year, companies and investors that stay flexible, address risks head-on and leverage creative deal structures can continue to find opportunities for growth and in this ever-changing market.

Bennett Jones M&A Practice

Bennett Jones' Mergers & Acquisitions practice spans all industries—particularly those that drive the Canadian economy. To discuss the developments and opportunities shaping the M&A landscape, please contact the authors.

* All numbers are according to S&P Global Market Intelligence in US dollars for announced, closed or pending deals—where a Canadian company is the acquirer, target or seller—as of September 30, 2025.