Subscribe to our Economic Outlook

Stay informed with the latest trends, strategies and tactics in outlook reporting.

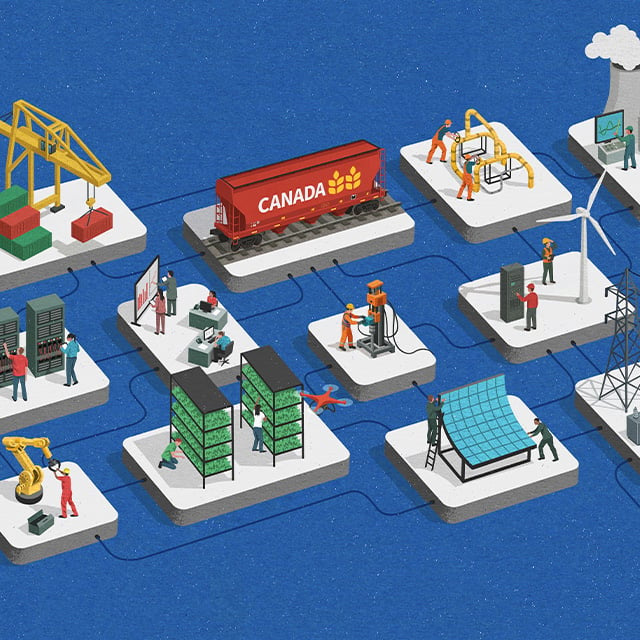

This biannual report and presentation from our Governmental Affairs and Public Policy group provides our clients with a unique, in-depth insight into the current and future state of the Canadian and global economies to help inform business planning.

The reality is setting in that our trade relationship with the U.S. is altered durably and that many of the tenets of the economic strategy that we pursued since the days of the original Canada-U.S. Free Trade Agreement and the Washington Consensus no longer hold. Shifting geopolitics are forcing a re-assessment of the means to safeguard our national security and sovereignty. AI is emerging as a powerful disruptive force in every corner of the economy, from energy to finance.

There is a shared vision of one, stronger Canadian economy that builds, diversifies its trade, sells more of its resources to the world, innovates, reorients its industries and attracts global talent and capital. The key to unlock this future is private investment that generates long-term returns. Yet, adjustment entails costs, and this will weigh on our standards of living. Not all bets will pay off.

Join us on Tuesday, December 16, 2025 for the Bennett Jones 2026 Economic Outlook, which will review this new global and North American context, the short-term economic prospects for Canada and the U.S. and some of the forces and choices that will shape the longer-term path.

Exceptional knowledge of Canadian government, international affairs, cross-border issues and policy development is a key component of our ability to provide clients with strategic legal business advice. Members of our Public Policy group have been invaluable for their leadership in shaping public policy in Canada, and in developing business responses to those policies.

Connect with us to learn more about how we can help you navigate your business' needs.

Stay informed with the latest trends, strategies and tactics in outlook reporting.